"It always seems impossible until it's done"

- Nelson Mandela

Service offering

We offer to professional clients discretionary management of their segregated accounts on the basis of Managed Account Agreement (template is Managed Account Agreement).

Our strategy is Long/Short Quantitative Equity investing:

- Fully automated trades based on a proprietary algorithm;

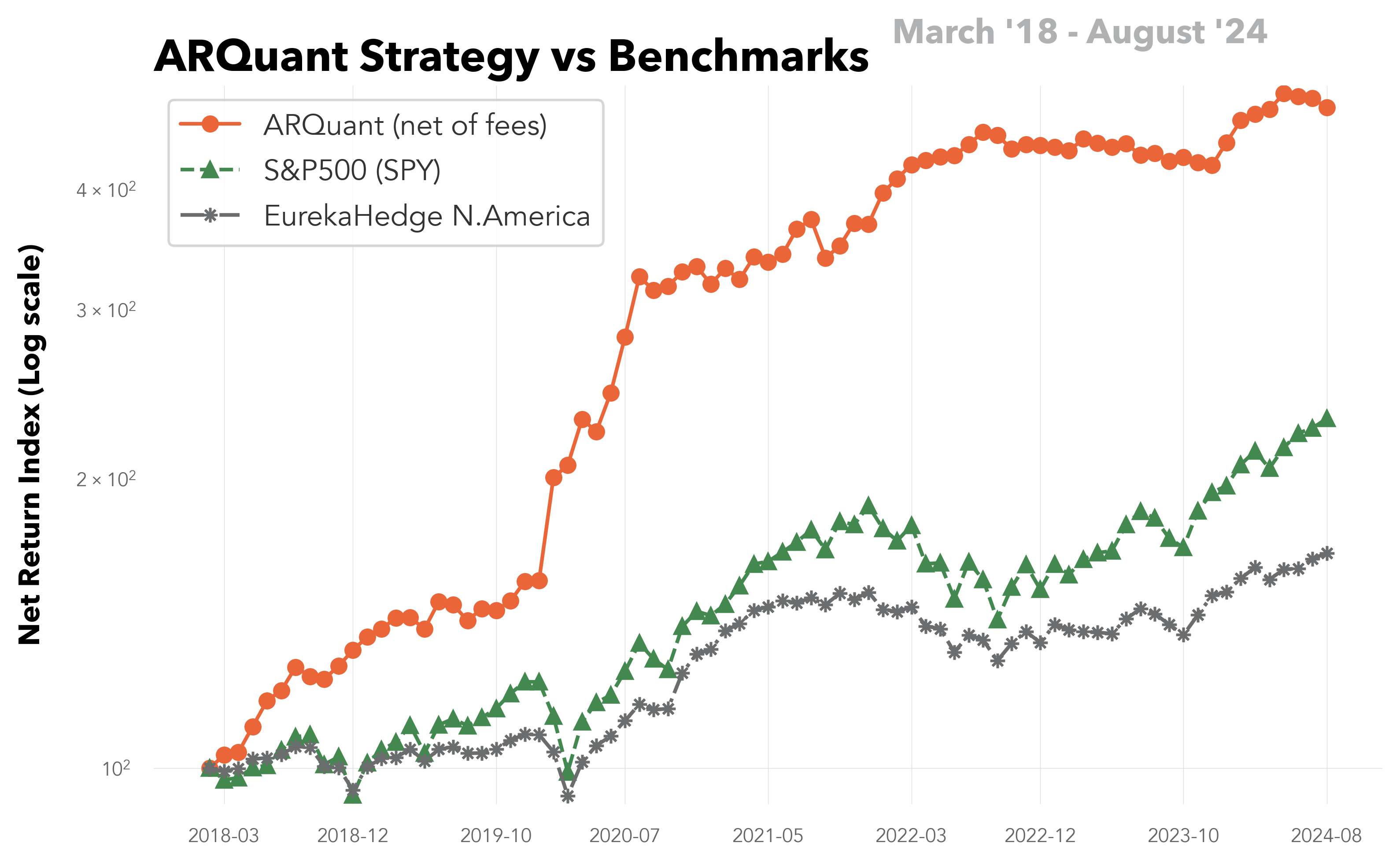

- Tested on personal accounts since March 2018;

- Long and short positions in US stocks traded on NYSE and Nasdaq;

- Stock selection is updated quarterly;

- All positions are short-term, average holding period is about 5 business days;

- Past returns since inception in March 2018 far outperformed the market while the market beta is almost zero and Sharpe above 2.0

See more statistics here.

Warning: “Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.”

Why us?

Firstly, our Quantitative Long Short US Equity strategy has been performing extremely well since 2018… (click here to see the plot)

Secondly, we all differ vastly and each one of us comes from a different ethnical background, yet each of our voices and contributions is heard equally. The strategy and the software was developed by Andrew, Dmitry is making it algorithmic, and making it marketable is being handled by Alexander. Such teamwork allows us to propose an investment product that can and will compete with the best in the industry.

Finally, we always deliver as promised, at any expense, because reputation values more than money. … (click to read more)

Our team

Alexander Semenyaka

Chief Executive Officer

Graduated with honors from the Faculty of Computational Mathematics and Cybernetics of Lomonosov Moscow State University in 1987 with a Ph.D. He has over 20 years’ experience as an executive in corporate finance. In 2018 Alexander got an MSc in leadership and strategy from the London Business School and in 2020 received a certificate from the EDHEC business school on asset management using machine learning. Since 2018, he has been selecting and testing unique algorithmic strategies.

Andrew Kartashov

Chief Investment Officer

Graduated with honours from the Faculty of Mechanics and Mathematics of Lomonosov Moscow State University in 2000 . He worked as a programmer, lead programmer and head of division in Russian IT companies. In 2008, Andrew began trading on the Moscow Exchange with his own money and since 2010 his trading is exclusively run by robots. In March 2018 he launched robotic stock trading on US exchanges.

Dmitriy Turevskiy

Chief Technology Officer

Graduated from the Faculty of Mechanics and Mathematics of Lomonosov Moscow State University in 2000. Worked as a lead developer, project manager and head of the IT department in software development and fintech companies. Since 2014, he is heavily involved in development of algorithmic trading software with strong emphasis on financial and mathematical statistics.

Contact us

ARQuant Management Limited, registered in England and Wales with Company number 13034143

Registered office:

167-169 Great Portland Street

Fifth Floor

London, W1W 5PF

Phone: 0333 050 9302

Alexander Semenyaka

Chief Executive Officer

Email: [email protected]

Andrew Kartashov

Chief Investment Officer

Email: [email protected]

Dmitriy Turevskiy

Chief Technology Officer

Email: [email protected]

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.