ARQuant’s Edge: Boosting Market Beta

Portfolios Through Superior Risk-Adjusted

Returns

ARQuant’s Edge: Boosting Market Beta Portfolios Through Superior Risk-Adjusted Returns

Summary

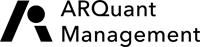

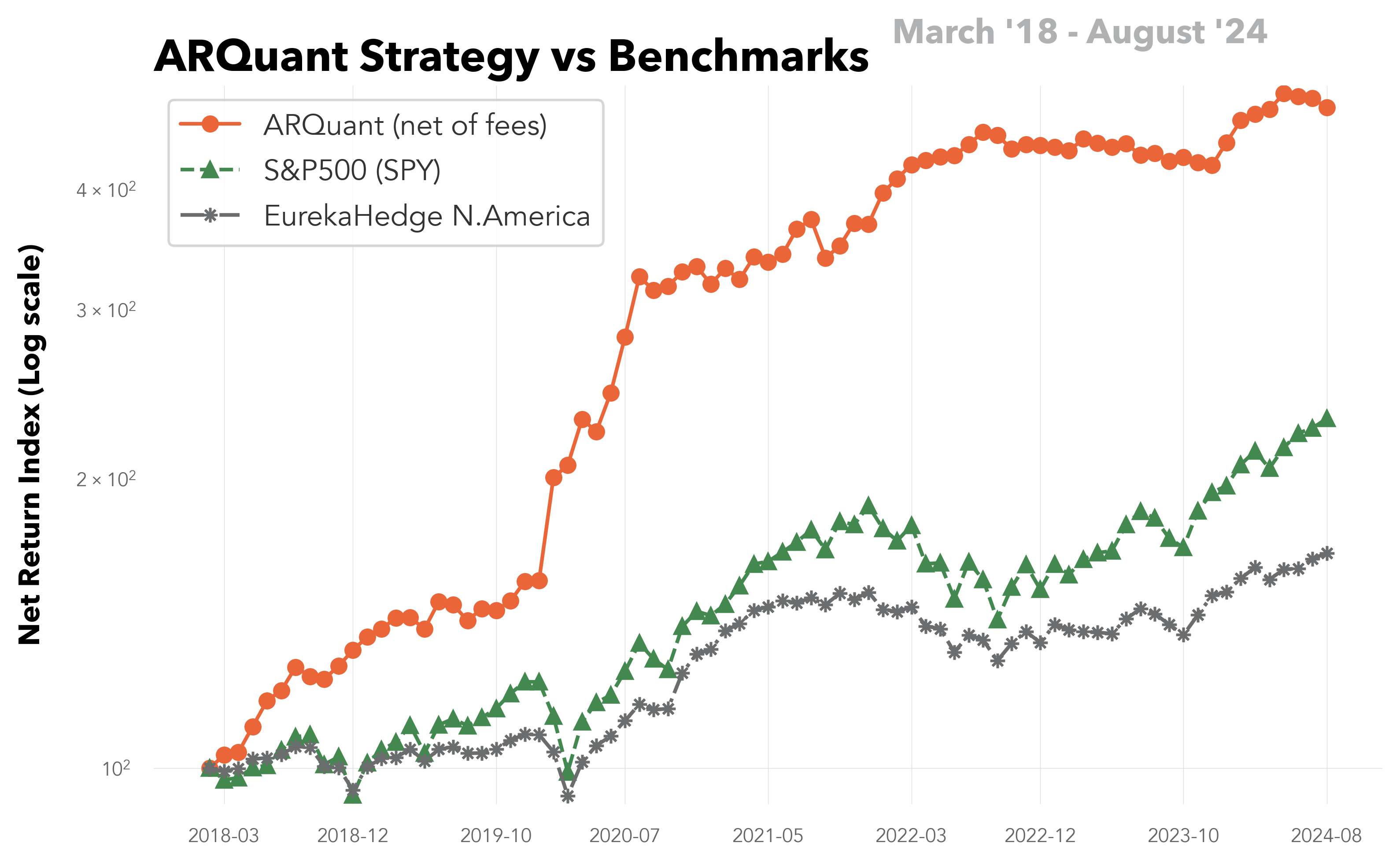

We are pleased to present our first white paper, titled “ARQuant’s Edge: Boosting Market Beta Portfolios Through Superior Risk-Adjusted Returns.” This paper explores how ARQuant’s algorithmic trading strategy can achieve superior risk-adjusted returns, particularly when combined with traditional market portfolios like such as the S&P 500.

By systematically optimizing Sharpe and Sortino ratios across various estimation methods and time periods, we found that allocating 30% to and 70% of a portfolio to the ARQuant strategy can significantly enhance the performance of a market beta core. These blended portfolios consistently outperform popular ETFs (e.g., SPY, QQQ, etc.) in key metrics such as volatility, drawdown, and return efficiency.

The full Article can be found here: ARQuants Edge: Boosting Market Beta Portfolios

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.