Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

| The World Wildlife Fund (WWF) | Help to transform the future for the world’s wildlife, rivers, forests and seas |

| Greenpeace | Protect our natural world for future generations |

| Save The Children | Help children get the future they deserve |

| CALM (Campaign Against Living Miserably) | Standing together against suicide |

| International Rescue Committee | Help refugee families |

| Cash For Refugees | Give cash directly to people displaced by the war in Ukraine |

| Zeilen Van Vrijheid | Deliver medical cars and humanitarian aid to Ukraine |

| Vostok SOS | Humanitarian and psychological help to people in Ukraine |

| DEC: Unkraine Humanitarian Appeal | Meeting the needs of all refugees and displaced people |

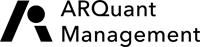

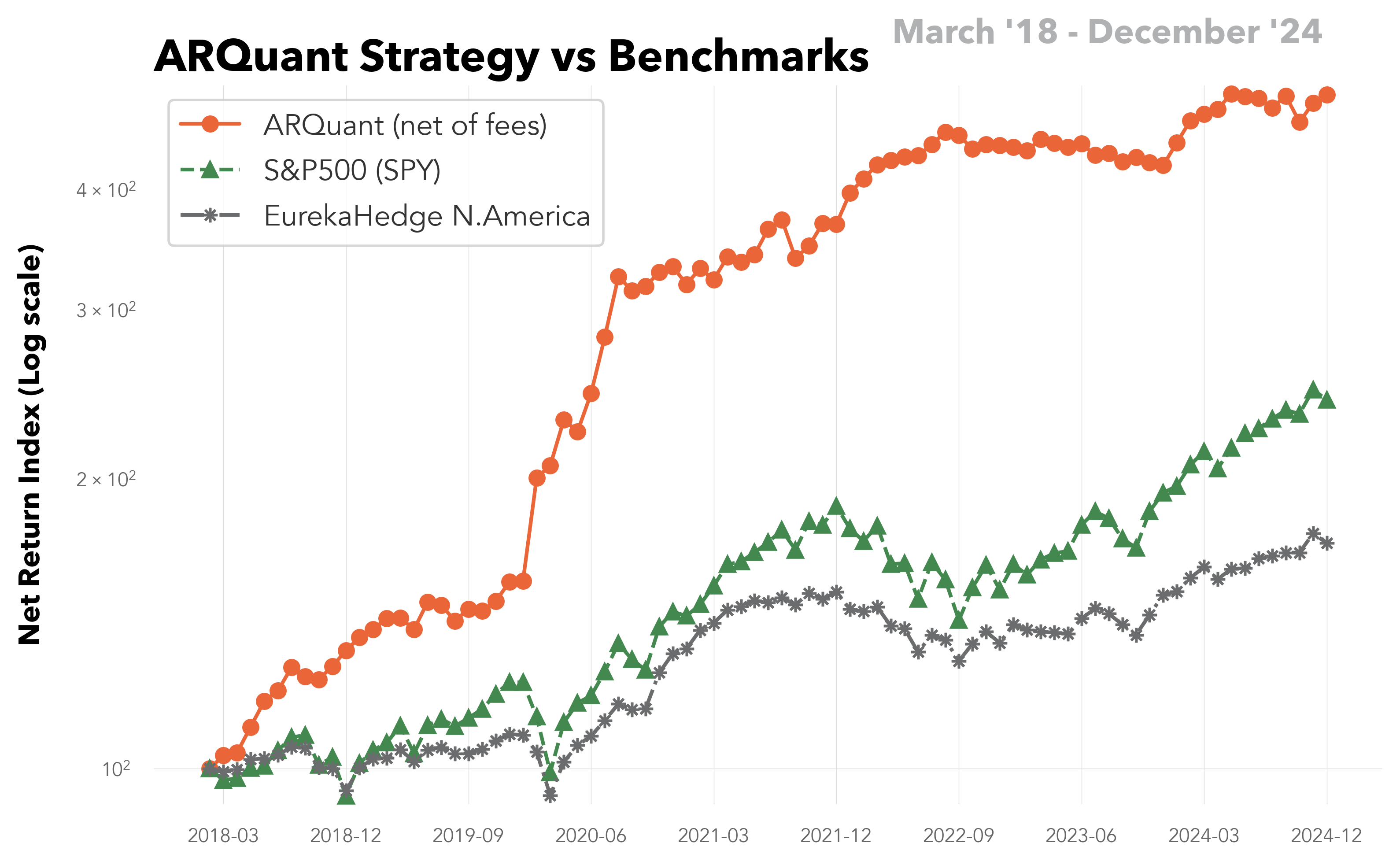

from March 2018 on the account of Dmitry Turevskiy

from April 2020 on the account of AVESA Group Limited

from April 2022 on the account of AVESA Group Limited under ARQuant Management Limited as Adviser

| Statistics | Inception | Last 36 Months | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|---|

| Start | 2018-03 | 2022-04 | 2018-03 | 2019-01 | 2020-01 | 2021-01 | 2022-01 | 2023-01 | 2024-01 | 2025-01 |

| End | 2025-03 | 2025-03 | 2018-12 | 2019-12 | 2020-12 | 2021-12 | 2022-12 | 2023-12 | 2024-12 | 2025-03 |

| Cumulative Return | 674.40% | 33.60% | 41.40% | 22.50% | 148.00% | 13.50% | 26.80% | -3.80% | 21.60% | 7.00% |

| CAGR% | 33.50% | 10.10% | 51.50% | 22.50% | 148.00% | 13.50% | 26.80% | -3.80% | 21.60% | 31.10% |

| Volatility annualized | 17.50% | 9.30% | 11.30% | 11.50% | 30.60% | 15.70% | 10.30% | 5.20% | 12.20% | 14.80% |

| Risk Free Rate | 2.44% | 4.34% | 2.00% | 2.10% | 0.40% | 0.00% | 2.02% | 5.07% | 4.97% | 4.21% |

| Sharpe Ratio | 1.62 | 0.62 | 3.61 | 1.65 | 3.19 | 0.88 | 2.18 | -1.7 | 1.27 | 1.62 |

| Calmar | 3.49 | 1.62 | 27.42 | 4.91 | 35.14 | 1.58 | 7.7 | -0.68 | 3.28 | |

| Sortino | 4.12 | 1.09 | 40.09 | 3.53 | - | 1.21 | 3.02 | -3.35 | 1.71 | |

| Kelly criterion | 0.1 | 0.12 | 0.37 | 0.17 | 0.11 | 0.06 | 0.25 | -0.15 | 0.15 | 0.19 |

| Skew | 1.84 | 0.15 | 0.11 | 0.04 | 0.81 | -0.84 | 0.45 | 0.64 | -0.75 | 0.35 |

| Kurtosis | 6.94 | 0.25 | -0.89 | -0.79 | 0 | -0.13 | -0.07 | 0.16 | -0.13 | -1.5 |

| VaR (5%) | 2.30% | 3.60% | 1.70% | 3.70% | 4.20% | 7.30% | 2.40% | 2.50% | 4.70% | 3.30% |

| Max Drawdown | -8.80% | -6.20% | -1.60% | -4.30% | -2.80% | -8.80% | 3.20% | 5.50% | 6.20% | 1.40% |

| Geo. Avg. Monthly | 2.40% | 0.80% | 3.50% | 1.70% | 7.90% | 1.10% | 2.00% | -0.30% | 1.60% | 2.30% |

| Volatility monthly | 5.10% | 2.70% | 3.30% | 3.30% | 8.80% | 4.50% | 3.00% | 1.50% | 3.50% | 4.30% |

| High Month | 28.00% | 7.00% | 9.30% | 7.60% | 28.00% | 6.40% | 7.80% | 3.00% | 5.70% | 7.00% |

| Low Month | -8.80% | -6.00% | -1.00% | -3.60% | -2.80% | -8.80% | -3.20% | -2.70% | -6.00% | -1.40% |

| Win rate weekly | 69.40% | 58.30% | 80.00% | 66.70% | 91.70% | 66.70% | 83.30% | 33.30% | 66.70% | 66.70% |

| Beta (S&P500) | 0.29 | 0.03 | 0.16 | 0.64 | -0.15 | 0.82 | 0.04 | 0.05 |

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

We walk the walking as we talk the talking.

In 2014-2020 Andrew worked as a managing director of Kuber Ventures Limited, a company regulated by FCA as appointed representative under reference number 574987, He was responsible for compliance and risk management and proved this ability to meet strict regulation rules without any FCA claims.

In early 2004, on a mortgage conference Alexander publicly committed his company would be able to issue mortgage-backed securities (RMBS) with a credit rating higher than the sovereign rating of Russian Federation. Nobody believed. In 2008, Alexander’s mortgage agency issued structured notes with the credit rating by one notch higher than the sovereign debt. Moreover, when in 2009 the credit rating of Russia was downgraded due to financial crisis, the RMBS’s rating remained the same so became two notches above.

In 2014, a dramatic year for Russian economy due to imposed sanctions and hight volatility on all domestic markets, Andrew was nominated among top 2% traders with the astonishing performance of 180% p.a. when he participated under the nick “robot_fisher” in the 2014 BEST PRIVATE INVESTOR CONTEST organized by the MOEX (Moscow Exchange)

In June 1996, Gazprom invited Alexander to push the market capitalization up when price per share was only $0.12. Just in 5 months, despite being under fire from criticism because of his implementation of the “ring fence”, Alexander and his team successfully organised a debut ADR placement on LSE. Five years later, when Alexander was invited to head a mortgage agency, the share price was above $4.0 per share)