April 2024 NewsLetter

Management comments

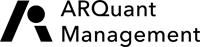

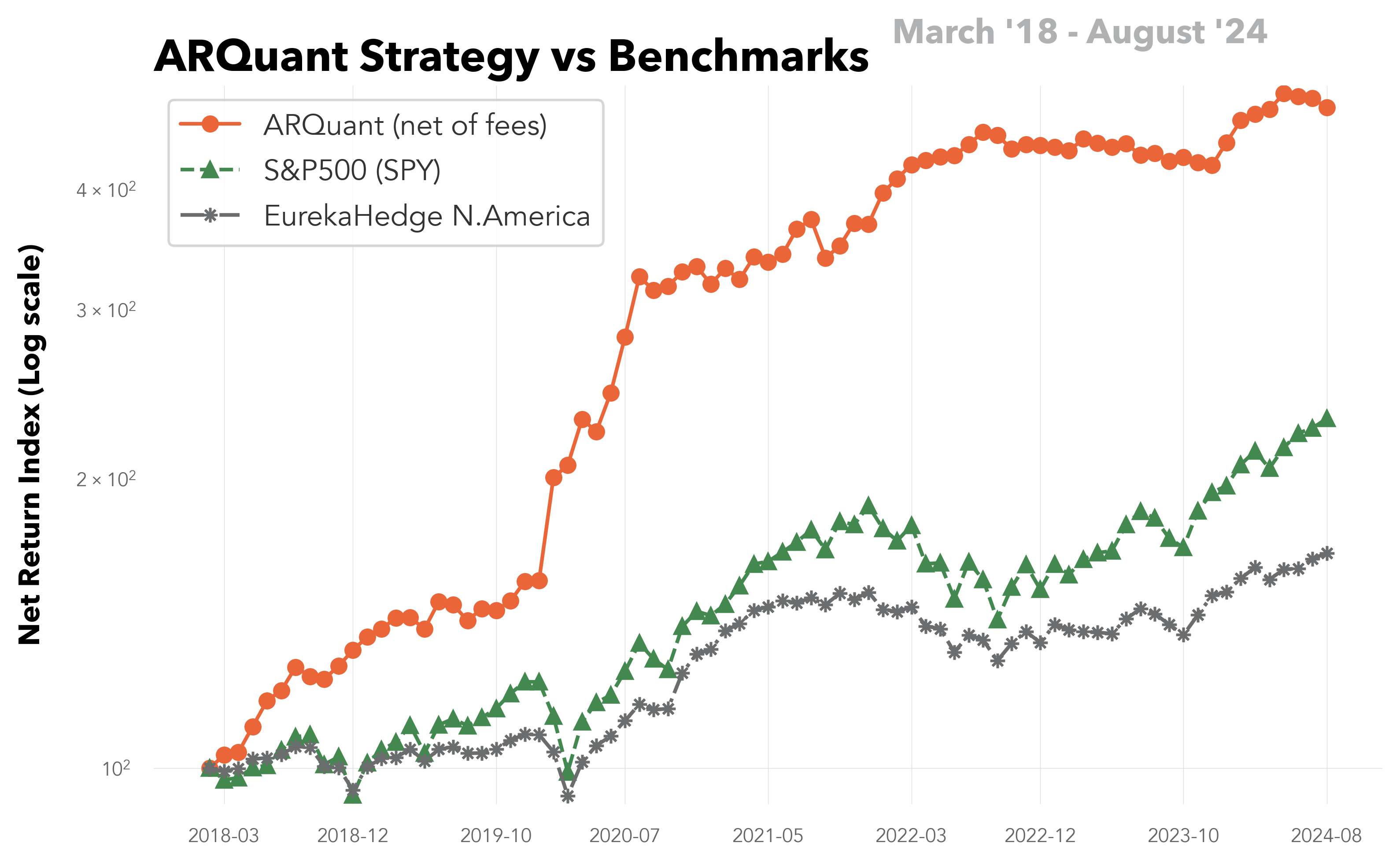

April proved challenging for the U.S. stock market with the S&P 500 declining by -4.2% as market momentum waned.

Our accumulated returns dipped into the negative twice over the course of the month. However, improvements we made in early April enabled the strategy to capitalize effectively on select days when certain stocks exhibited strong momentum, facilitating swift recoveries. As a result, our strategy showed on the reference account a positive monthly performance of 1.52% (before fees).

The reference account, with a modest size of $350k, traded only 22 stocks. Larger client accounts permit a more diversified trading strategy by incorporating a greater number of stocks with smaller allocations, which typically enhances performance. For instance, a $2 million client account under the same strategy realized a monthly return of 2.43% (before fees), benefiting from a portfolio that included 31 actively traded stocks.

The strategy outperformed the EurekaHedge North America Long Short Equities Hedge Fund Index, which posted a decline of -1.82% in April (as of May 8, 2024).

Last Month

The second day of April stood out as the most lucrative, with a daily return of 2.19%. Conversely, 10 days later, the 12th April was marked as the least favorable, recording a daily loss of -1.89%.

YTD

January recorded the highest gross monthly return at 5.68%, whereas April saw the minimum with a monthly gross return of 1.52%.

The full Newsletter can be found here: ARQuant Newsletter 2024-04

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.