August 2023 NewsLetter

Management comments

The changes we made to the trading system in July have harvested some benefits in August when the robot showed +0.43% monthly net return. The old system selected stocks over a 3-year period (long memory) and the new system is now able to screen the last 12 months (short memory) combining them with the long memory. As a result, the robot was trading 40 stocks last months compared with 19 tickers in July. We managed to keep the criteria for stock selection and portfolio construction unchanged while significantly improving portfolio diversification. It’s is too early to conclude if the improvement is sustainable, but we remember what Winston Churchill said “Continuous effort – not strength or intelligence – is the key to unlocking our potential”.

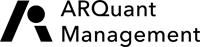

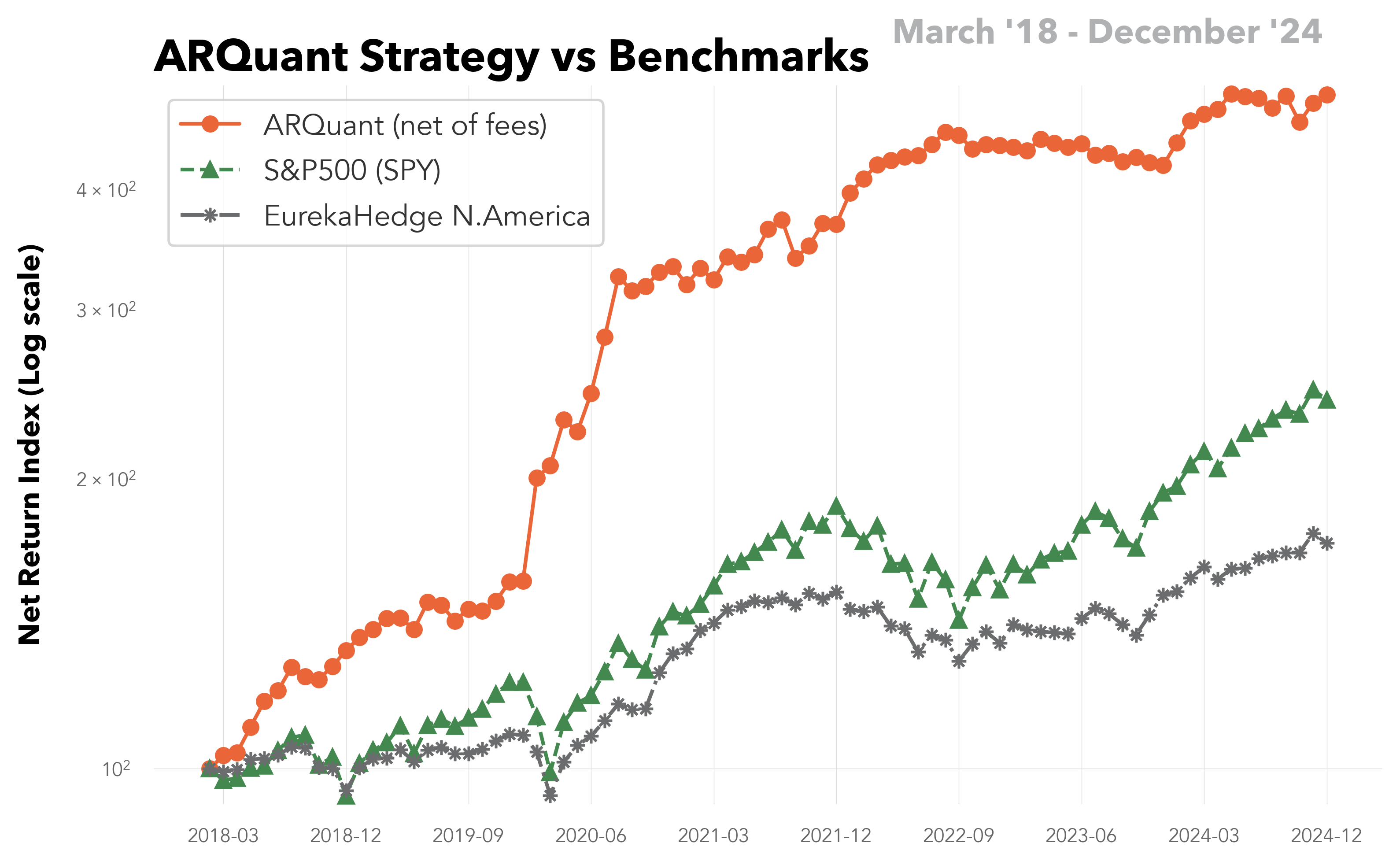

The ARQuant strategy outperformed the benchmark EurekaHedge North America Long Short Equities Hedge Fund Index (-1.1% p.m. as published on September 9, 2023)

Last Month

The best day was 29-Aug with daily return of 1.23% and 10-Aug was the worst day when daily losses reached -1.89%.

YTD

This year March remains the best month with 2.96% p.m. gross, and July is the worst with -2.66% p.m. gross.

The full Newsletter can be found here: ARQuant Newsletter 2023-08

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.