February 2024 NewsLetter

Management comments

February was yet another high-performing month for our trading strategy, which yielded a gross return of 5.56%. We enhanced our quantitative model, refining our stock selection algorithm to exclude the impact of low liquid securities, exemplified by the early month losses attributed to SCHW.

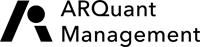

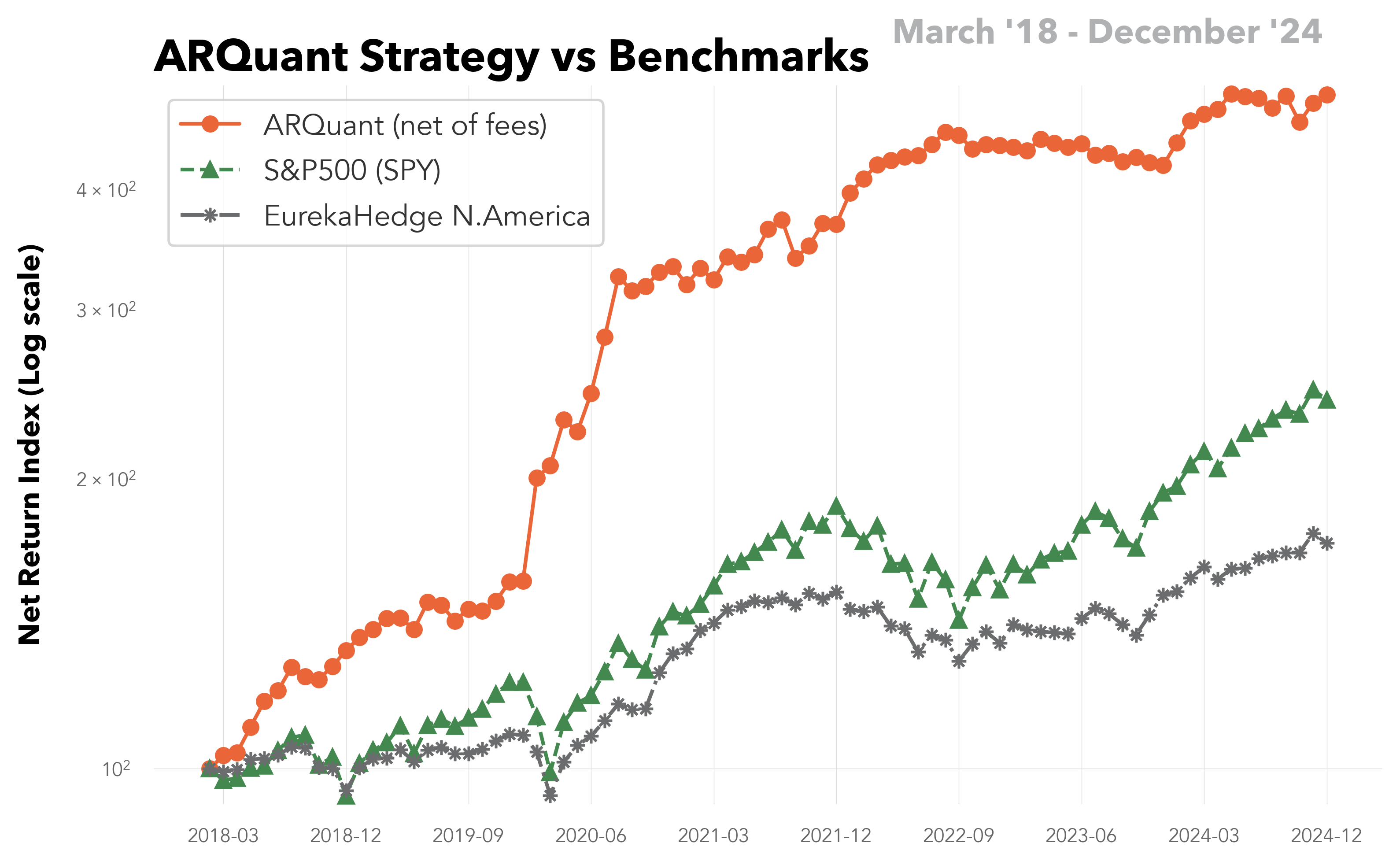

The strategy substantially outperformed its benchmark – EurekaHedge North America Long Short Equities Hedge Fund Index which reported an increase of 3.68% (as published on March 5, 2024).

ARQuant Management has expanded its services through the Interactive Brokers (IB) platform by instituting the Money Manager role. This addition strategically diversifies our direct-to-consumer approach, integrating a B2B2C component. Investment advisors now have the option to engage ARQuant as a sub-advisor, enabling us to manage partitions of their client portfolios. We are poised to offer a white label solution tailored for family offices or join forces with multi-manager hedge funds, as we’ve recently done with one.

Last Month

The trading session on the 5th of February stood out as the most lucrative, with a daily return of 2.49%. Conversely, the subsequent session on the 6th of February was marked as the least favorable, recording a daily loss of -1.42%.

L12M

Within the last 12-month period, January 2024 posted the highest gross monthly return at 5.68%, while July 2023 experienced the lowest with a gross return of -2.66% per month.

The full Newsletter can be found here: ARQuant Newsletter 2024-02

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.