January 2024 NewsLetter

Management comments

In January, we observed a shift in market conditions, which our trading system adeptly navigated, achieving an impressive 5.68% monthly return (gross). A key driver of this success was the performance of NDVA , which showcased robust momentum. Our system was effectively able to identify and capitalize on trading patterns in this stock, leading to lucrative trades. Additionally, transactions across most other stocks also yielded profitable outcomes.

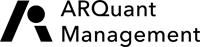

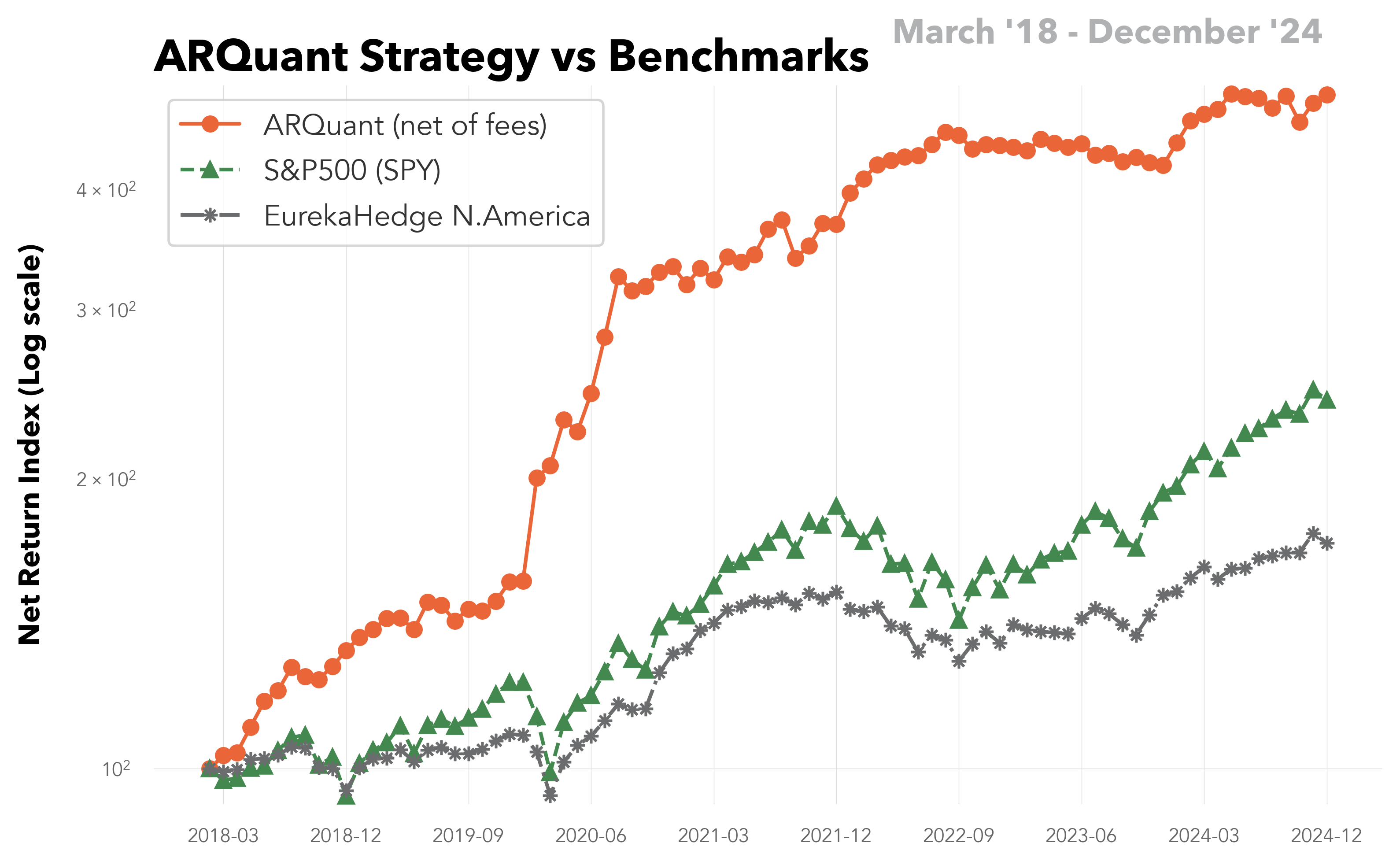

Our strategy significantly outperformed the EurekaHedge North America Long Short Equities Hedge Fund Index, which posted a gain of +0.88% for the same period, as reported on 7-Feb 2024.

The successful implementation of implied volatility in December paved the way for a pivotal enhancement in January. By refining our approach, we were able to mitigate the risk associated with unpredictable stock movements during the early trading hours. This innovation could have enhanced our results significantly over the past two years. We are now more confident in our trading system’s ability to navigate a variety of market conditions effectively. As we look forward, we remain cautiously optimistic, bearing in mind the wisdom of not counting our chickens before they hatch.

Last Month

The best day was the 8th January with daily return of 2.0% and 17th January was the worst day when daily loss reached -1.23%

YTD

This is the first month in a year.

The full Newsletter can be found here: ARQuant Newsletter 2024-01

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.