May 2022 NewsLetter

Management comments

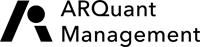

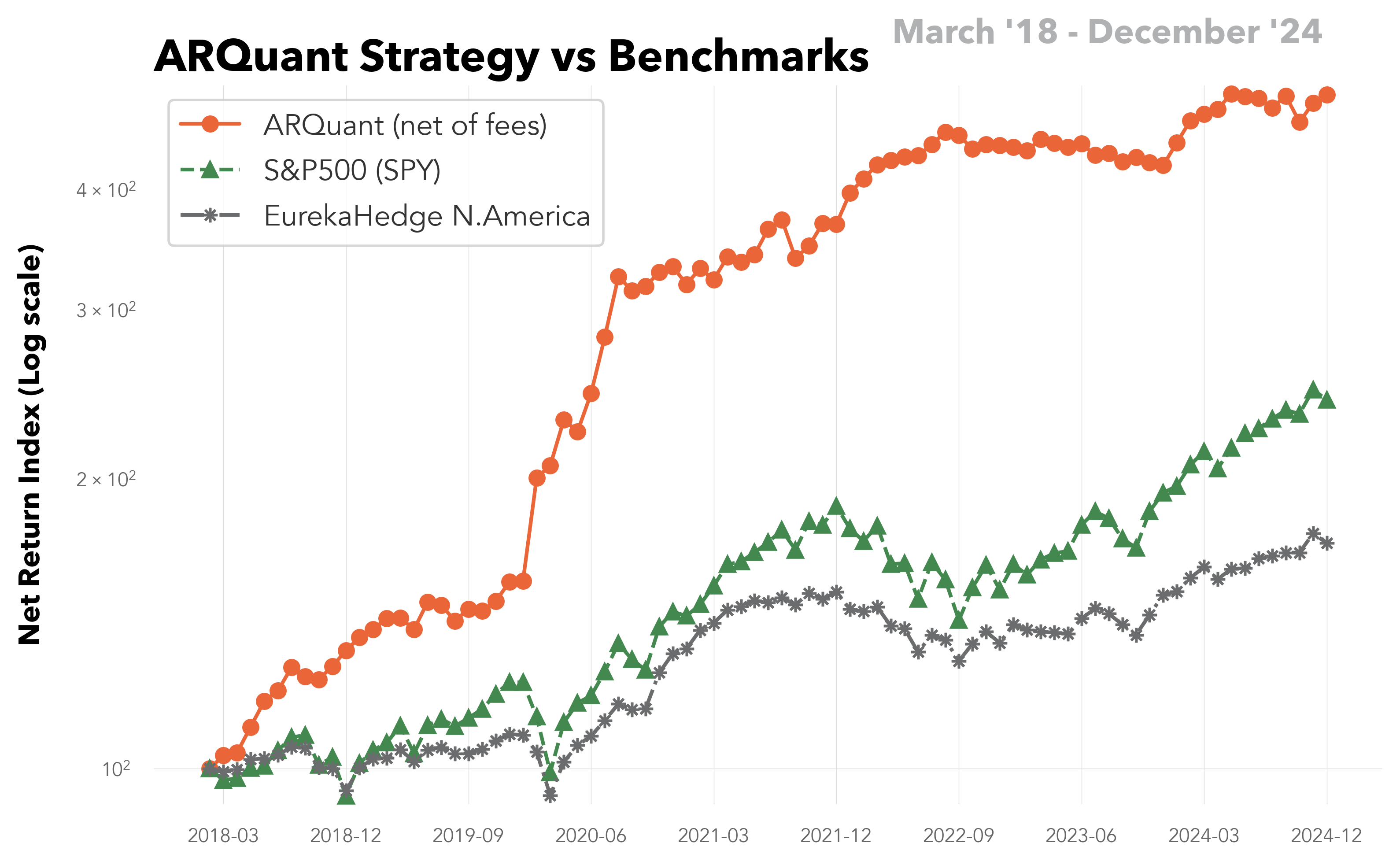

The month of May was a challenging period for ARQuant’s trading strategy when the US stock market (S&P500) gapped up and down almost every day. In such a volatile market, the robot traded conservatively and mostly sat in cash which paid off.

During the first decade the algorithm performed very well however gross exposure didn’t exceeded 56%. When uncertainty increased the priority became to control risks and minimize losses, and the strategy halved the exposure. The longest peak-to-valley period happened from 10th to 25th May when accumulated losses reached 2.8%. Last week of May granted more certainty and the robot took this chance to recover almost all the losses.

In May ARQuant’s investment strategy generated 0.9% p.m. gross return and outperformed S&P500 (0.01% p.m.), FRI EH Quantitative Directional Index (0.15% p.m.) and Eurekahedge North America Long Short Equities Hedge Fund Index ( -0.13% p.m.) In general, the strategy has performed as it should – generated absolute return and effectively managed volatility.

Last Month

May 9 was the best day when daily return reached 2.04%, while May 5 was the worst day with

a single day drawdown of 1.59%.

Year-to-Date (YTD)

January is still the best month of this year with 7.84% monthly return (before fees), and May has happened

to be the weakest month with 0.97% monthly return (before fees).

The full Newsletter can be found here: ARQuant Newsletter 2022-05

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.