May 2024 NewsLetter

Management comments

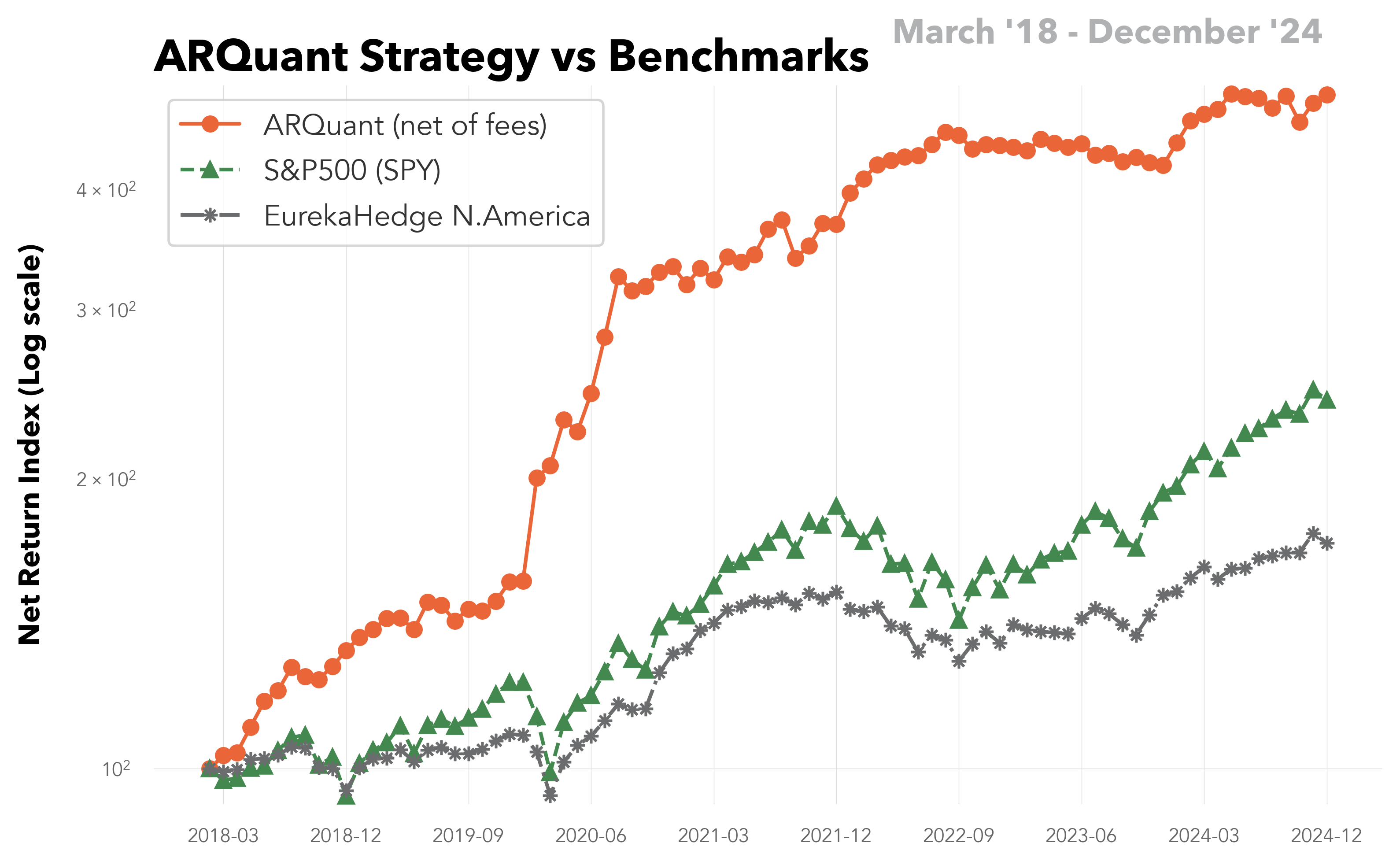

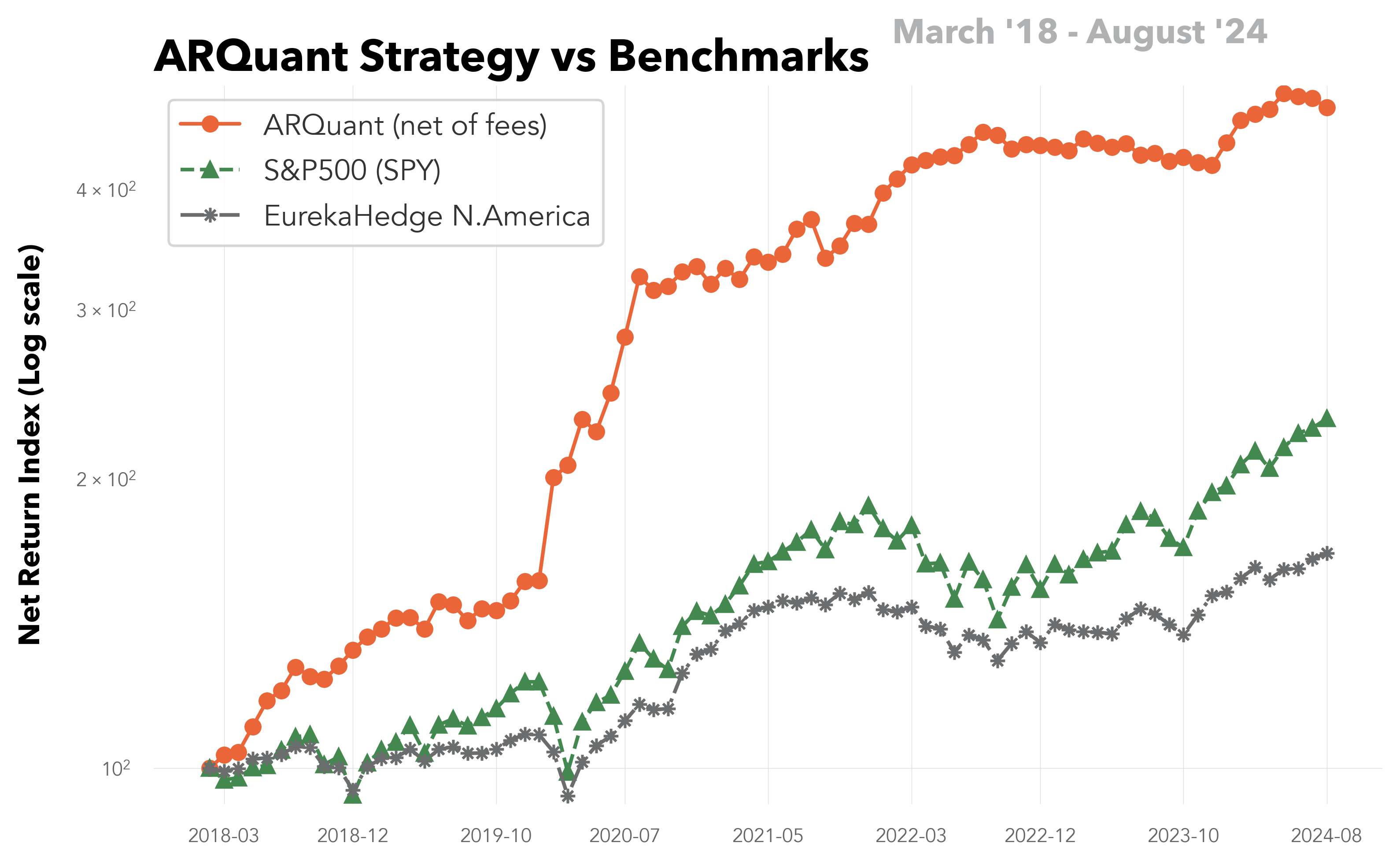

The S&P 500’s 4.8% gain last month represented its strongest May performance since 2009. However, May presented challenges for the ARQuant’s strategy due to a lack of sustained momentum, with only a few days contributing significantly to our performance. Despite these conditions, the strategy achieved a monthly profit of 5.0% before fees on the smallest account, 5.8% on the biggest unleveraged account and 6.4% on accounts with 25% permanent leverage.

We are constantly enhancing our trading system and the next update is scheduled to rolled out in June. As expected, the update will further reduce a risk of overfitting and improve out-of-sample predictions.

The strategy outperformed the EurekaHedge North America Long Short Equities Hedge Fund Index, which reported a return of 2.85% in May (as of June 9, 2024), and continues to deliver nearly three times better YTD performance.

Since Jan-2024, ARQuant has doubled its assets under management, reaching USD 17 million.

Last Month

The 15th of May stood out as the most lucrative, with a daily return of 4.3%. Conversely, 2 weeks later, the 29th May was marked as the least favourable, recording a daily loss of -1.1%.

YTD

January recorded the highest gross monthly return at 5.68%, whereas April saw the minimum with a monthly gross return of 1.52%.

The full Newsletter can be found here: ARQuant Newsletter 2024-05

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.