November 2022 NewsLetter

Management comments

In November the ARQuant software successfully predicted 14 out of 21 trading days and made profit. However, most days internal risk controls did not allow the robot to use a bigger leverage because of the drawdown in October. Gross exposure was low with mean at 17% (21% in October) and net exposure mean was 0% (5% in October).

During the first ten days, the stocks traded by the robot had quite strong momentum (see the RSI subplot; DISCLAMER: the algorithm doesn’t trade on RSI signal which is used for illustration purpose only), and profit was gradually accumulated. Then, most of the days the ARQuant algorithm could not detect predictable behaviour on the market so a recovery after the local drawdown was slow enough.

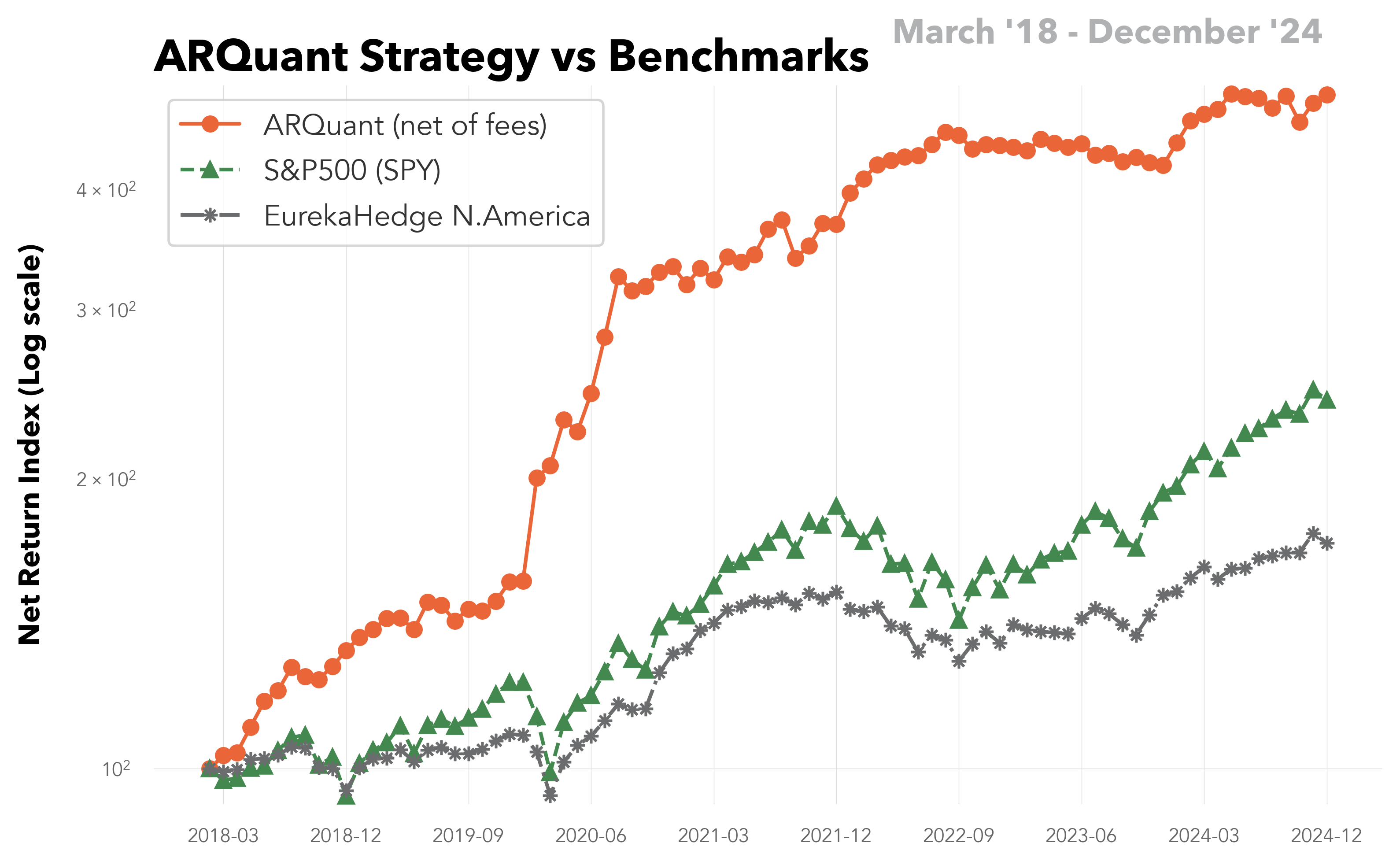

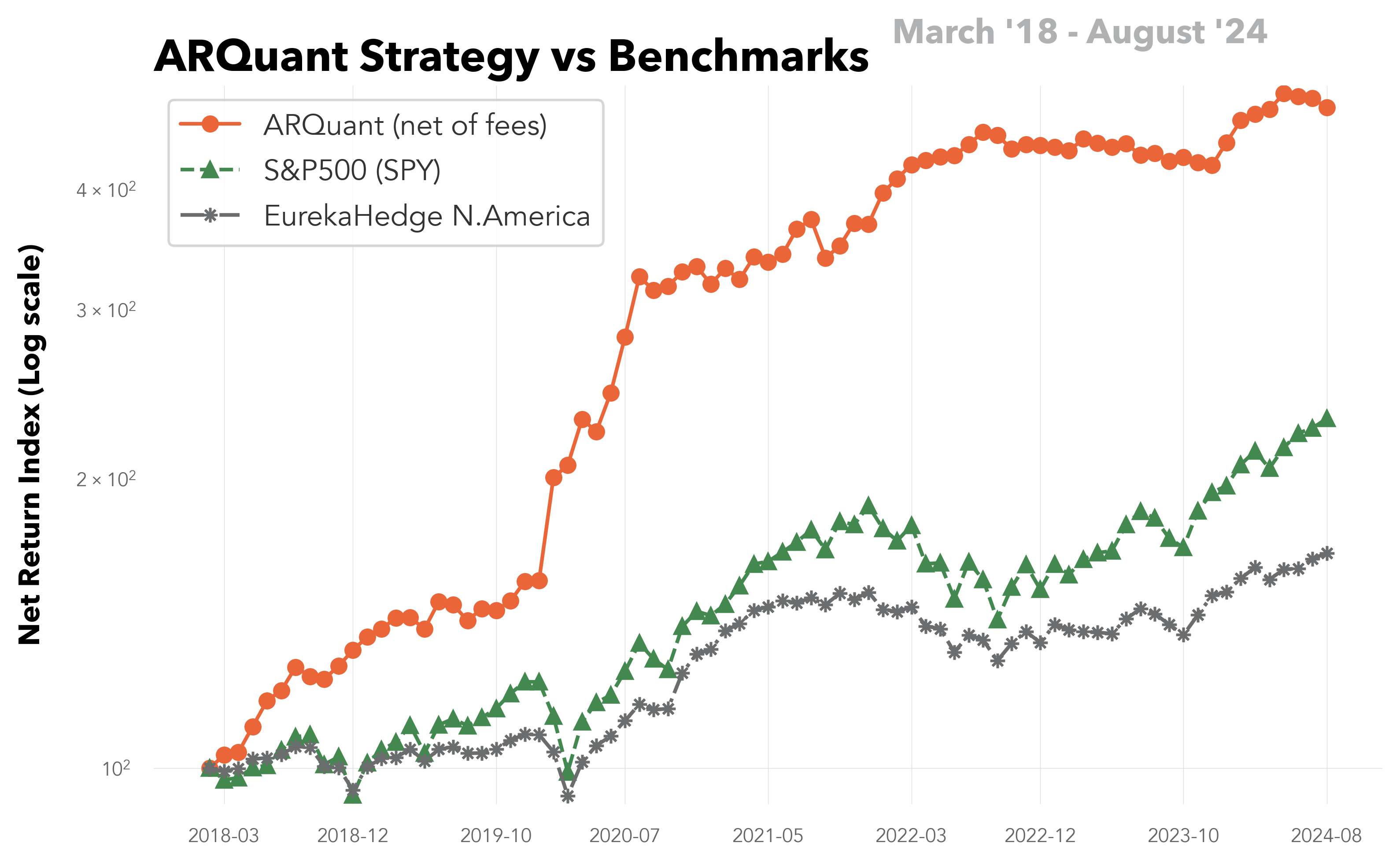

As a result, last month our performance (1.14% gross) fell behind the benchmarks HFRI EH Quantitative Directional Index (5.99%) and Eurekahedge North America Long Short Equities Hedge Fund Index (2.20%). However, our YTD return (27.0% gross) is still far better than the both benchmarks (-2.55% and-9.21%).

Last Month

The best day was 30-Nov with daily return of 0.9% and 10-Nov was the worst day when daily losses were -1.45%.

Year-to-Date (YTD)

January remains the best month of the year with 7.84% p.m. gross return, and October was the worst month with -3.18% gross loss.

The full Newsletter can be found here: ARQuant Newsletter 2022-11

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.