November 2024 NewsLetter

Management comments

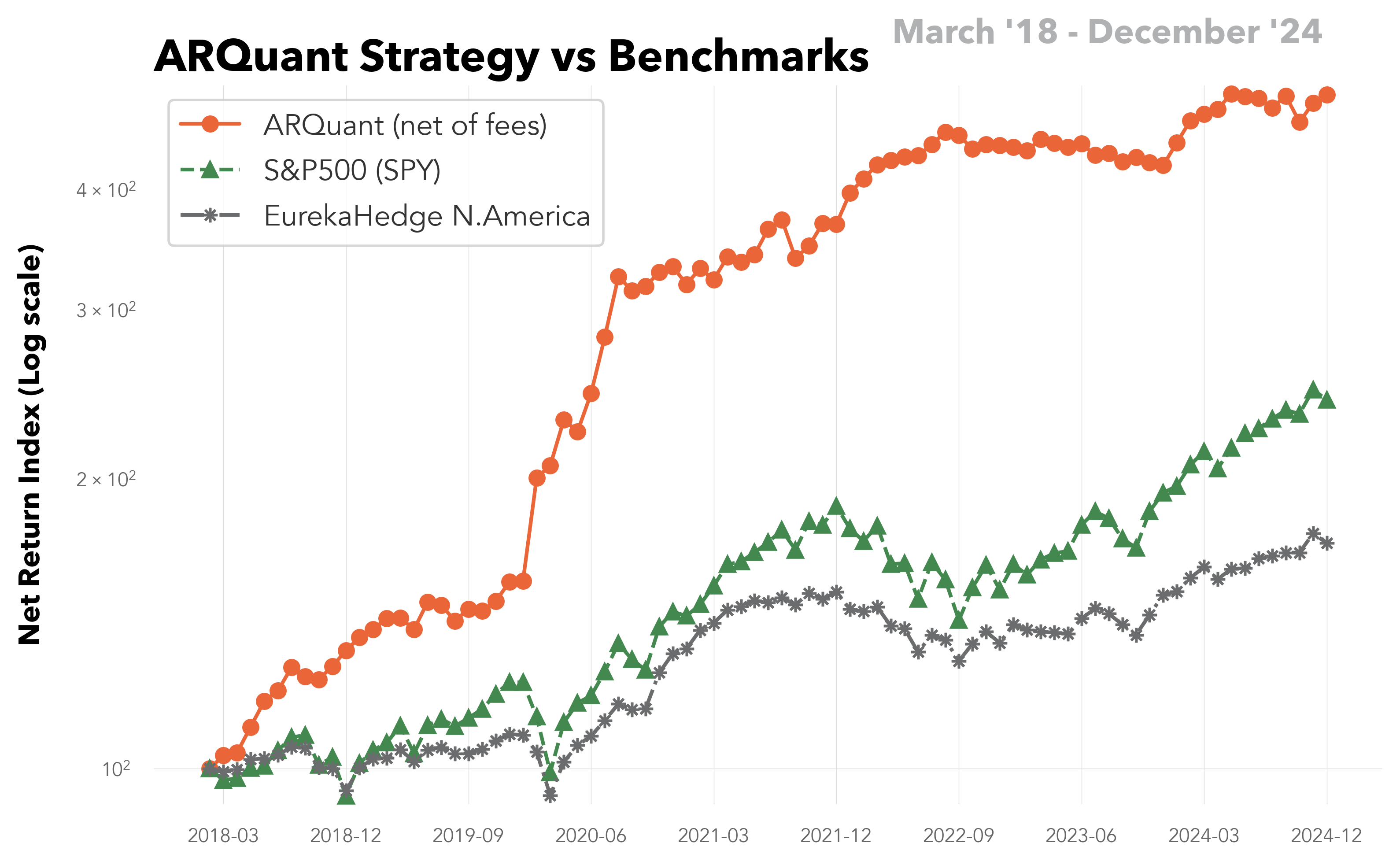

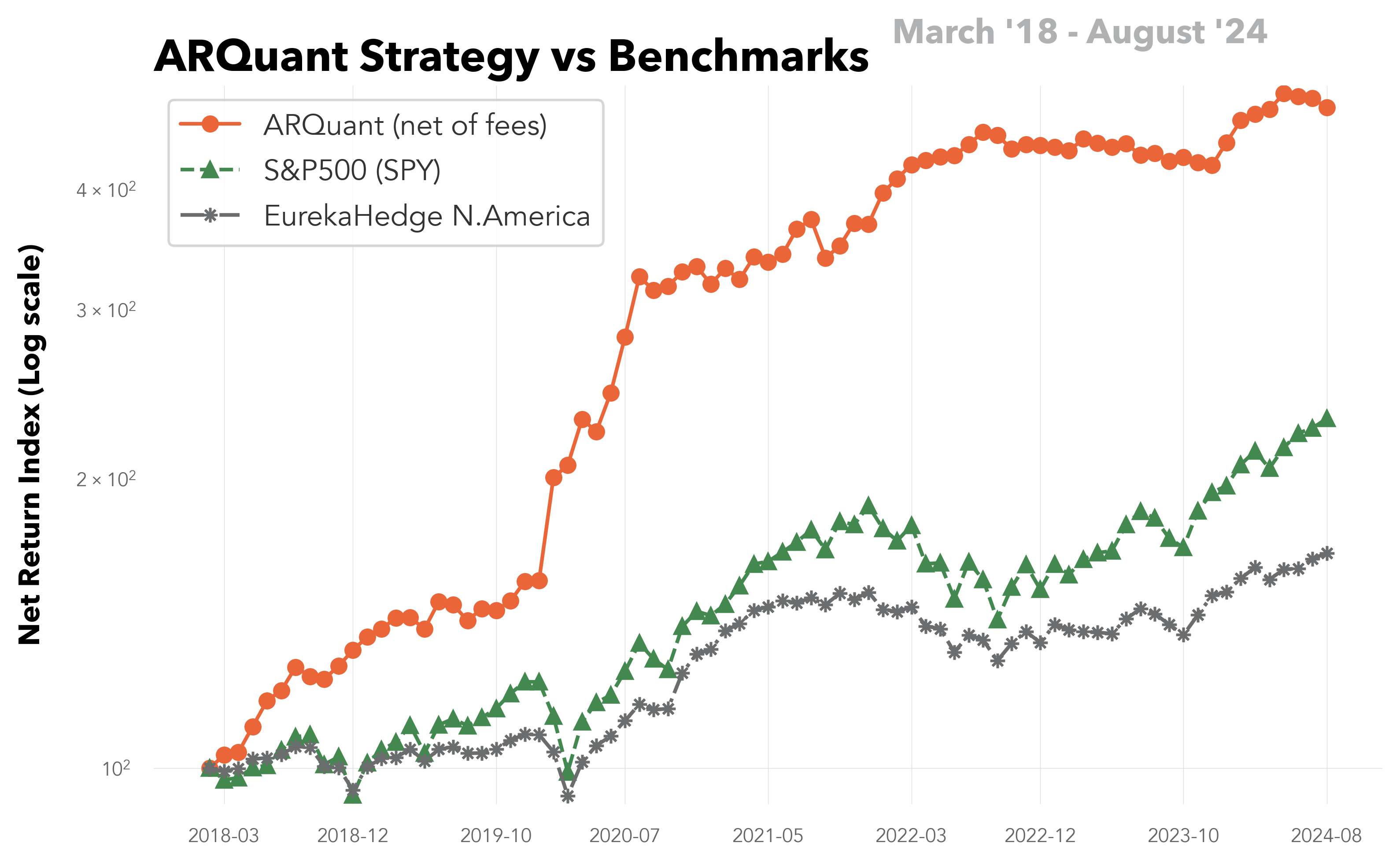

In November, the strategy demonstrated strong recovery and consistent performance, capitalizing on the stabilization of the market following the U.S. presidential election. The uncapped strategy fully recovered the October’s losses, while its capped modification targeting 3% monthly nearly achieved the same. The latter is presented in this newsletter.

Positive daily returns between November 6th and 11th propelled cumulative returns far above the target so the capped strategy activated the protection mechanism and reduced the portfolio exposure. The strategy’s ability to identify and capitalize on stocks with strong momentum at optimal times played a crucial role in navigating these market conditions. This highlights the adaptability and effectiveness of our trading system in seizing opportunities as they arise.

The strategy outperformed the EurekaHedge North America Long Short Equities Hedge Fund Index, which reported a monthly profit of 4.49% (as of 06/12/2024). It maintains a year-to-date performance of 16.08% (after fees), closely matching the benchmark’s 15.72%.

Last Month

On November 6th, the strategy recorded its highest daily return of 3.26% gross. In contrast, November 1st marked the worst day, with a daily loss of -0.83% before fees.

YTD

January recorded the highest gross monthly return at 5.68%, while October became the lowest with a negative return of -5.98% gross.

The full Newsletter can be found here: ARQuant Newsletter 2024-11

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.