October 2024 NewsLetter

Management comments

October began on a steady note, and by mid-month the strategy accumulated a profit above 2%. However, as the U.S. elections drew closer, market volatility intensified due to uncertainty around the election outcome, causing stocks associated with different candidates to experience sharp fluctuations. This heightened intraday volatility led to accumulated losses as we approached the final days of the month. Another contributing factor to the monthly losses was SMCI (Super Micro Computer) stock unexpected overnight gap of -30% before opening on October 30th. The stock was long in our portfolio contributing a loss of about -4.5%. The loss could have been even higher but our risk management system had limited an exposure in advance.

As a result, the strategy ended the month with a loss of -5.98% before fees.

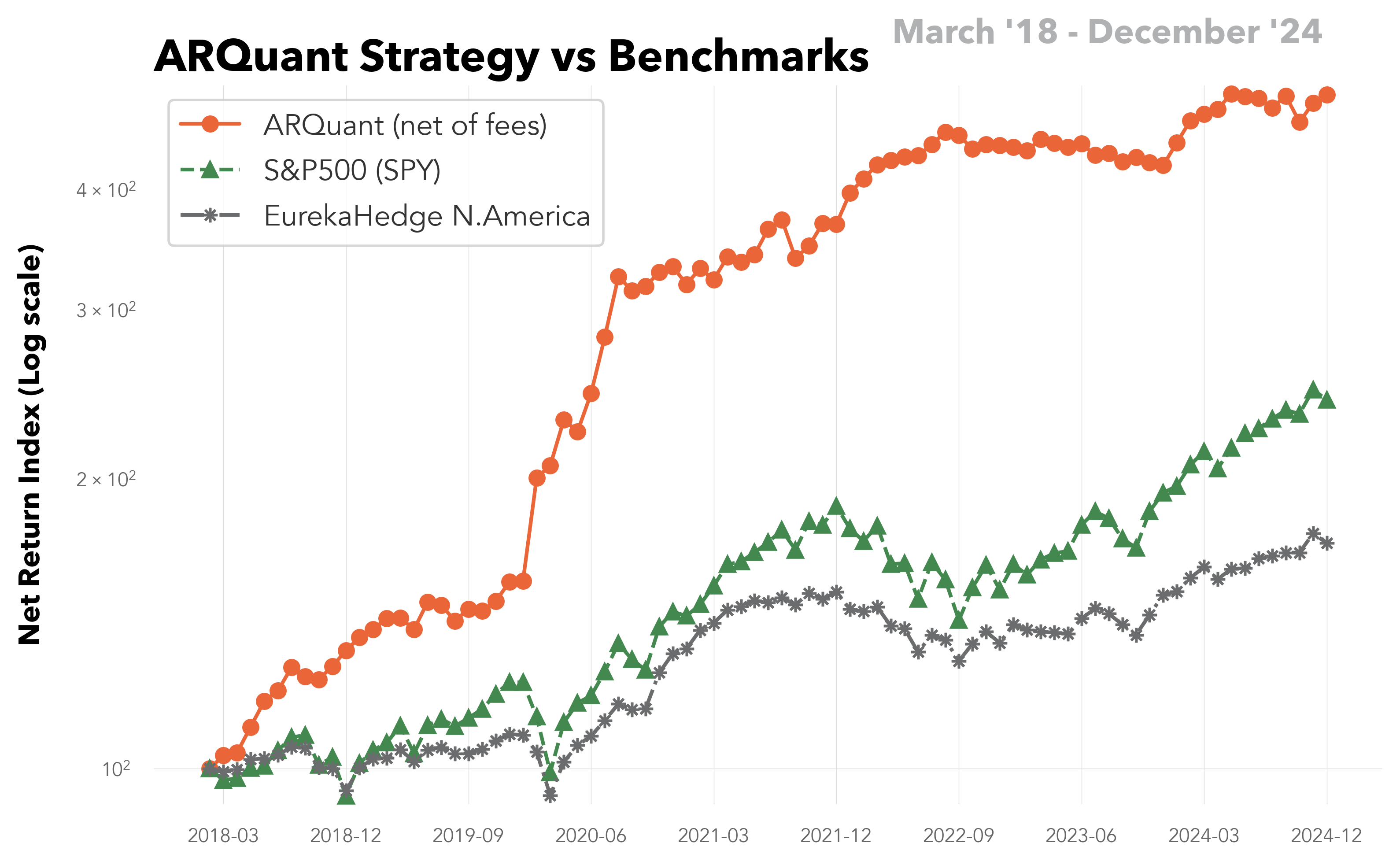

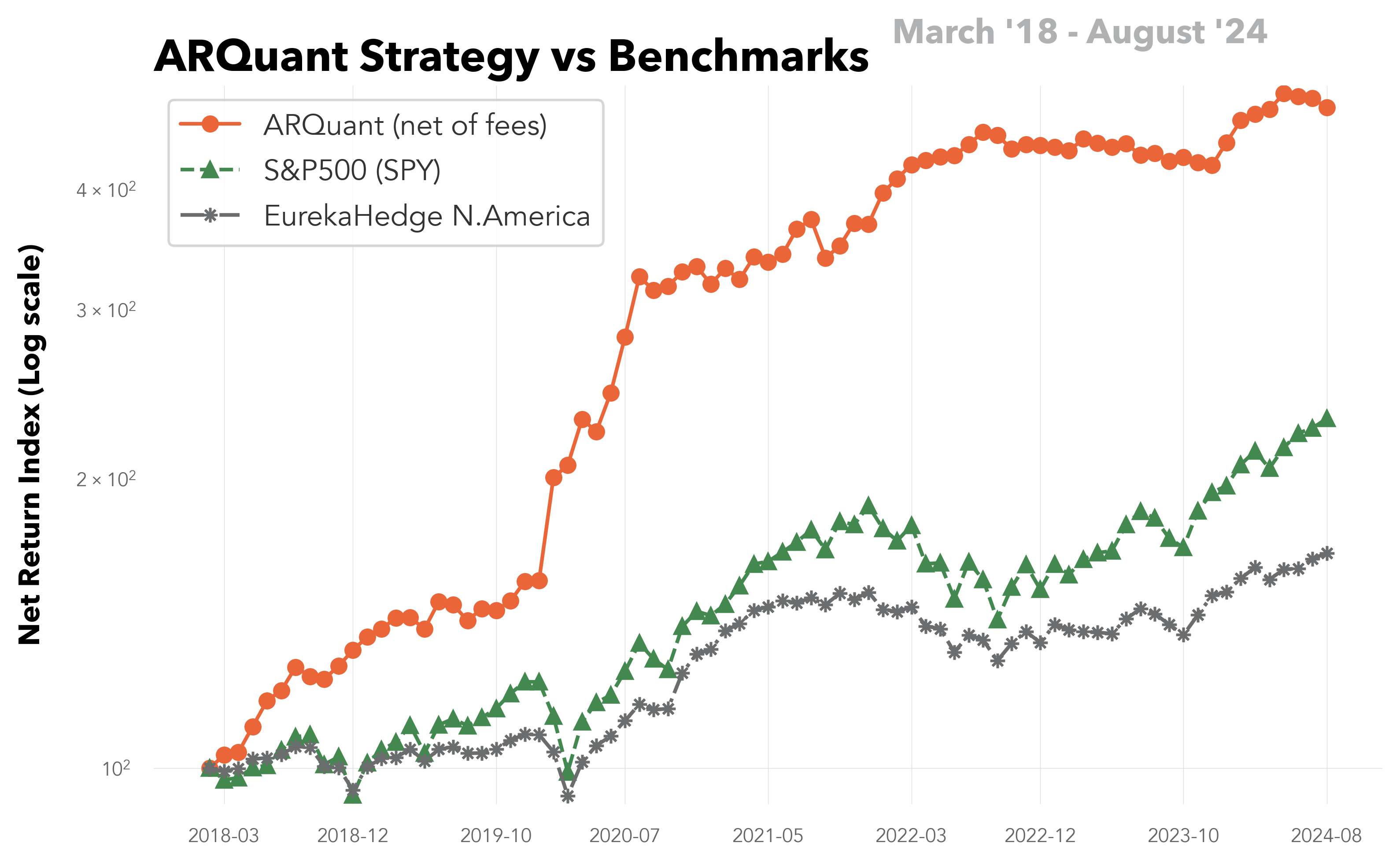

The strategy underperformed the EurekaHedge North America Long Short Equities Hedge Fund Index, which reported a monthly profit of 0.2% (as of 11/11/2024). Nonetheless, the strategy maintains a year-to-date performance of 10.92% (after fees), closely aligning with the benchmark’s 10.99%.

Last Month

On October 14th, the strategy recorded its highest daily return of 1.66%. In contrast, October 30th marked the worst day, with a daily loss of -4.77%.

YTD

January recorded the highest gross monthly return at 5.68%, while October became the lowest with a negative return of -5.98% gross.

The full Newsletter can be found here: ARQuant Newsletter 2024-10

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.