September 2023 NewsLetter

Management comments

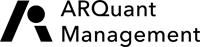

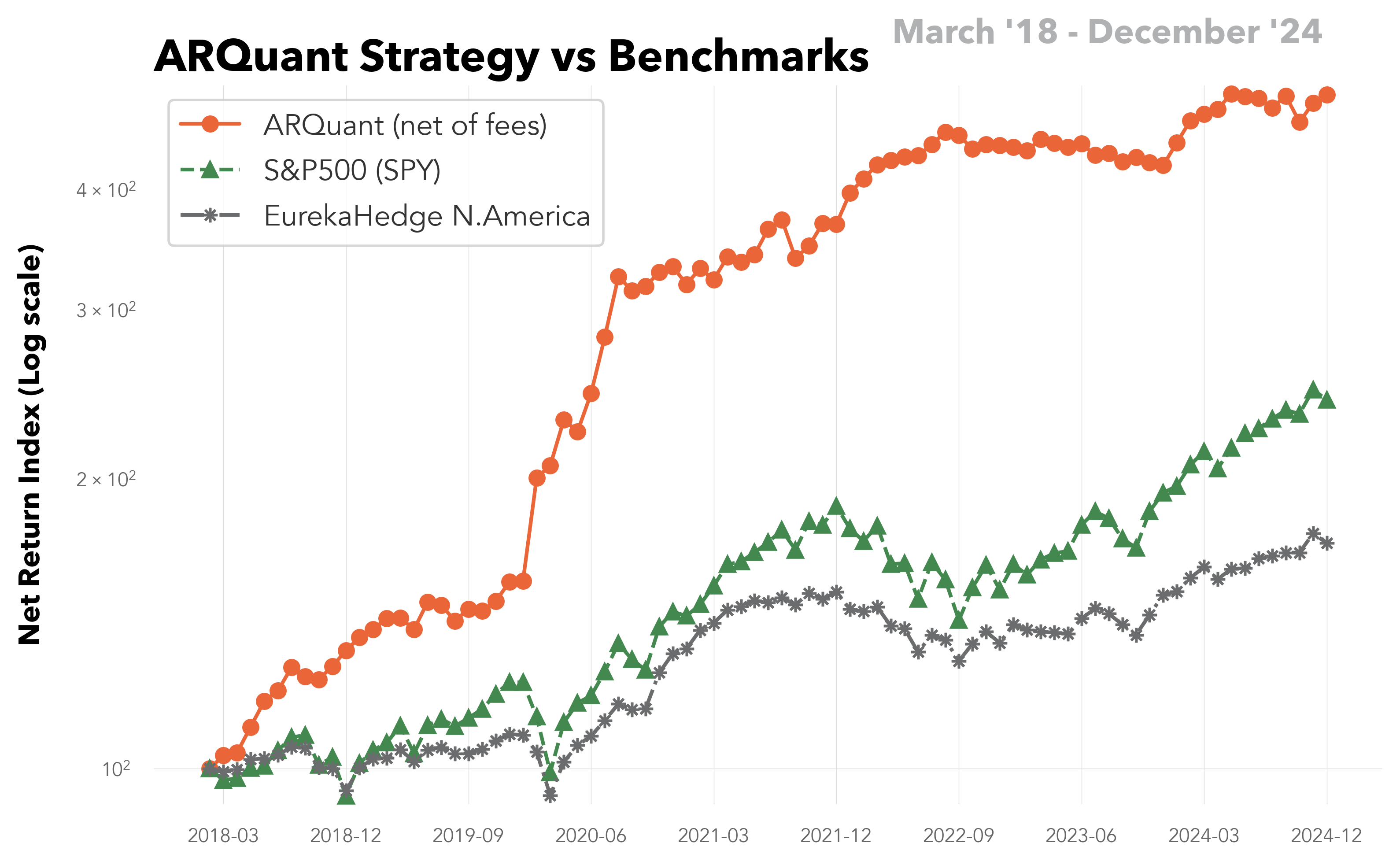

Since the strategy inception, September was always, except 2019, a bad month for our algorithm. This September the gross performance was -1.83% while the S&P500 fell by -4.87%. The improvements of trading system we made in August have been geared to diversify the portfolio and to recognise new patterns of market behaviour. As a result, 19 stocks (out of 31 actively traded) generated profit but their contribution in total was smaller relative to the bad performers. We keep improving the algorithm with focus on portfolio optimisation and making optimisation faster and better fitted to heightened market volatility.

Last month gross exposure of the portfolio was considerably lower compared to August, and average net exposure was negative. The ARQuant strategy performed very similar to the benchmark EurekaHedge North America Long Short Equities Hedge Fund Index (-1.97% p.m. as published on October 6, 2023)

Last Month

The best day was the 1st September with daily return of 0.77% and 6th September was the worst day when daily losses reached -0.89%.

YTD

This year March remains the best month with 2.96% p.m. gross, and July is the worst with -2.66% p.m. gross.

The full Newsletter can be found here: ARQuant Newsletter 2023-09

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.

Warning: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Diversification does not ensure against loss. There is no guarantee that these investment strategies will work under all market conditions and each investor should evaluate their ability to invest for a long-term especially during periods of flat market or downturn in the market.